What is the true cost of college?

www.degreechoices.com is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

College is cheaper than we assume. Almost every day brings a new headline about the soaring costs of college, including claims that it’s no longer affordable for most students to pursue a degree, that tuition and fees are sky-high, and that college has become “so expensive” that it’s out of reach for almost everyone but students from wealthy families.

Largely misunderstood or ignored by many of these claims are the real facts about the costs of attending college. Here’s a quick summary of what – on average – students are currently paying to attend both 2-year and 4-year colleges.

The most recent data on college costs comes from a College Board report entitled Trends in College Pricing and Student Aid 2022. Contrary to many accounts in the press, the report shows that, after adjusting for the 8.3% inflation rate in the first 8 months of this year, compared to last year, average published tuition and fees declined in all 3 of higher education’s largest sectors: public 4-year colleges, public 2-year schools, and private nonprofit colleges. That’s the second year in a row that inflation-adjusted college tuition has decreased.

Popular online programs

www.degreechoices.com is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Published tuition prices vs. net tuition

Much of the confusion about the real cost of college involves the distinction between published price (or sticker price), which tends to grab headlines, and net tuition, which refers to the price students actually pay for college after government grants and institutional financial aid are factored in.

It’s true that published tuition prices typically increase each year at most colleges (although some have instituted controversial tuition freezes. This makes it appear that tuition and fees are increasing dramatically, often outpacing inflation.

But here is what’s important to remember – most students do not pay the sticker price. They pay a discounted rate, which, after grants and scholarships, is far less than the published tuition rate.

Consider the following figures. In 2022-2023, the average published tuition and fees for full-time college students increased by:

- 1.8% at public 4-year colleges (in-state students): $10,940, $190 higher than in 2021-22

- 2.2% at public 4-year colleges (out-of-state students): $28,240, $620 higher than in 2021-22

- 1.6% at public 2-year schools (in-district students): $3,860, $60 higher than in 2021-22

- 3.5% at private nonprofit 4-year colleges: $39,400, $1,330 higher than in 2021-22

However, a look at net tuition reveals a very different picture. According to College Board, in 2019-20, 75% of public 2-year, 78% of public 4-year, and 88% of private nonprofit 4-year students received some federal, state, or institutional grant aid. In this article, all data is for first-time, full-time undergraduates.

In 2019-20, 75% of public 2-year, 78% of public 4-year, and 88% of private nonprofit 4-year students received some federal, state, or institutional grant aid.

In 2021-22, undergraduate students received an average of $15,330 per full-time equivalent student in financial aid. This consisted of $10,590 in grants, $3,780 in federal loans, $870 in education tax credits and deductions, and $90 in federal work-study. As a result:

- At public 2-year colleges, students received enough grant aid on average to cover their tuition and fees (but not their room and board, and other educational costs), just as they have ever since 2009-10.

- The average net tuition and fees paid by in-state students at public 4-year institutions is estimated at $2,250, the lowest it’s been since 2006-07 and down more than $1,800 from a peak in 2012-13 of $4,060.

- The average net tuition and fee price paid by students enrolled in private nonprofit 4-year institutions is an estimated $14,630, also the lowest since 2006-07.

» Read: Public vs private colleges: which type of college is the best investment?

Factoring in the average cost of room and board at college

Students living on campus are charged room and board costs that vary depending on the type of plan they choose. For students living off campus, these costs are likely to be even higher. Then there’s the costs of books, transportation, and miscellaneous charges that, when added to tuition and room and board, add up to what’s called the total cost of education or net cost of attendance (COA).

What is net cost of attendance (COA)?

Net COA is the total price of tuition, room and board, and other expenses associated with attending college offset by financial aid in the form of scholarships and grants.

Let’s look at the published and the net COA figures for first-time, full-time students in 2022-23.

- For in-district students attending a public 2-year college, the published COA was $19,230. Meanwhile, net tuition, fees, and room and board amounted to $8,750, while net COA was $14,500, the lowest it’s been in more than 10 years.

- At public 4-year institutions, the published COA was $27,940. But net tuition, fees, and room and board amounted to $14,560; net COA was $19,250, the lowest since 2006-07.

- The average published COA at private, nonprofit colleges was $57,570. But the net tuition, fees, and room and board costs were $28,660. Net COA was $32,800, the lowest since 2006-07.

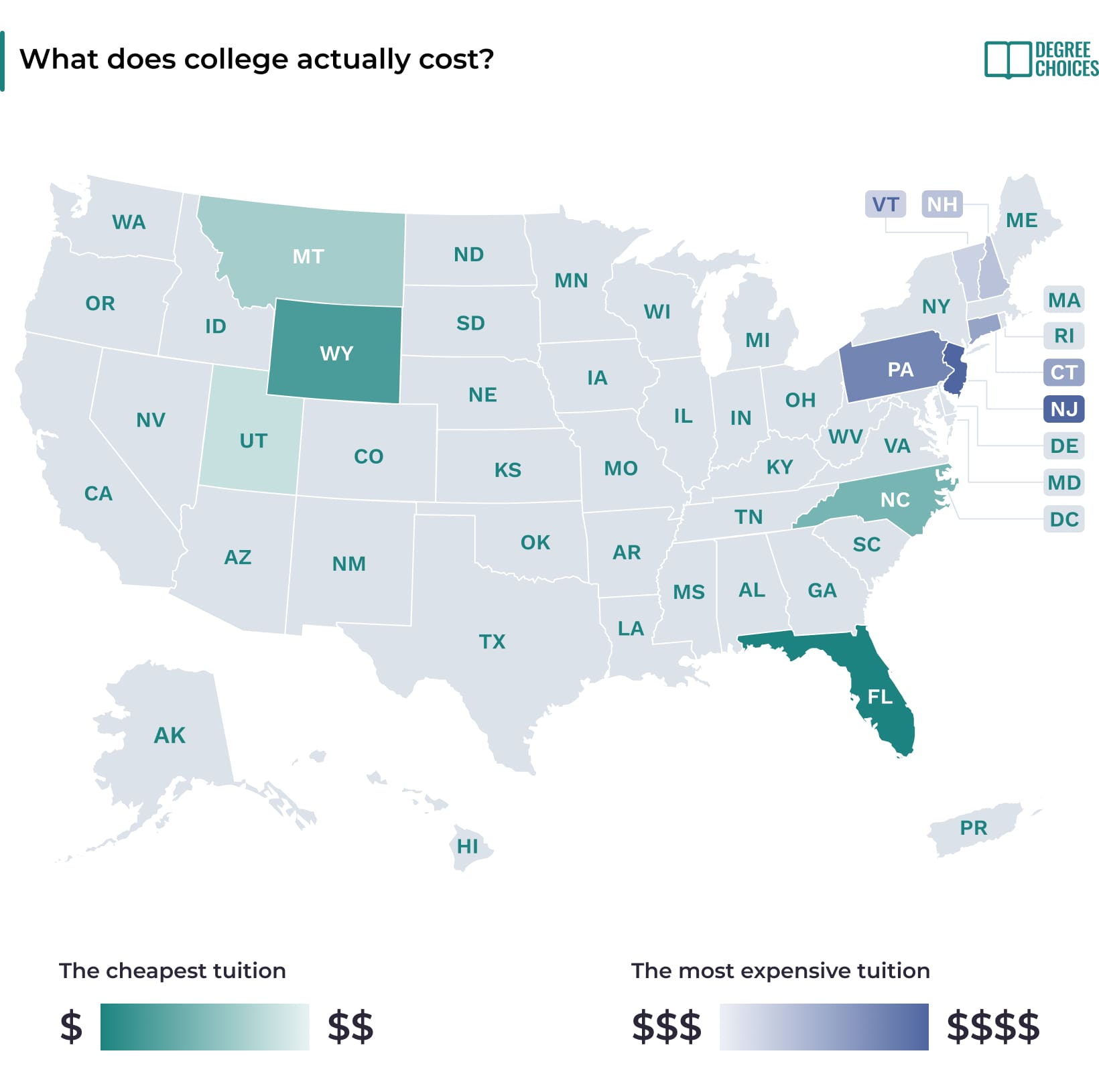

The states with the cheapest college tuition

Other factors need to be kept in mind when trying to anticipate what going to college will cost. For example, tuition and fee expenses – both published and net – vary considerably by state.

The 2022-23 tuition and fee average for in-state students attending 4-year public institutions was $10,940. Florida had the lowest average 4-year tuition at $6,370.

The national 2022-23 published tuition and fee average for in-state students attending 4-year public institutions was $10,940. Florida had the lowest average 4-year tuition at $6,370, followed by Wyoming, North Carolina, Montana, and Utah. Vermont was the most expensive, with an average in-state tuition of $17,650, followed by New Hampshire, Connecticut, Pennsylvania, and New Jersey.

At public 2-year colleges, which continue to be a vital component of American higher education, the national average for tuition was $3,860. California had the lowest rate: $1,430 for students paying in-district rates. It was followed by New Mexico, North Carolina, Arizona, and Texas. Vermont’s 2-year colleges were by far the most expensive with an average 2-year tuition rate of $8,660. The next most expensive were South Dakota, New Hampshire, Massachusetts, and Oregon.

| Cheapest | Most expensive |

| 1. California | 1. Oregon |

| 2. New Mexico | 2. Massachusetts |

| 3. North Carolina | 3. New Hampshire |

| 4. Arizona | 4. South Dakota |

| 5. Texas | 5. Vermont |

The opportunity cost of going to college

Another factor to consider is what economists call opportunity cost, which refers to the wages that a student foregoes while attending college as a result of delaying entry into the labor market.

We estimate that in the past 5 years, the average annual earnings of a college graduate have increased by about 14%.

Calculating those opportunity costs is tricky, and they vary for several reasons – including the state of the economy and whether one works while in college. One estimate put them at $120,00 in lost wages for someone pursuing a BA degree. Of course, those opportunity costs are typically recouped by students a few years after graduating because of the increased earnings that a college degree holder receives compared to someone without a degree. However, the return on investment provided by different degrees varies from college to college, with some providing a better ROI than others.

» Read: How we calculate the best college degrees based on ROI

Calculating that return on investment is also complex – but it appears to be growing. We estimate that in the past 5 years, the average annual earnings of a college graduate have increased by about 14%, so the time it takes to make up for the opportunity costs of college attendance is likely decreasing.

Final thoughts

No one disputes that college can be expensive, and that for hundreds of thousands of students – such as parents with young children who must pay for childcare – there is a large affordability gap that may make college inaccessible.

A new report from the National College Attainment Network found that most 2- and 4-year public colleges were unaffordable to the average Pell Grant recipient. Although Pell Grants were intended to increase access to higher education for low-income students, the buying power of the grants has decreased over the years, leading many policymakers and higher education leaders to call for the doubling of the current Pell Grant maximum to a total of $13,000.

Colleges need to work hard to control their costs, legislatures need to provide them adequate support, and federal and state financial aid needs to be increased for those students with need. Perhaps most importantly, the public needs to know the true costs of college so that students can make the best possible personal choices about whether and where to pursue their education.

www.degreechoices.com is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.